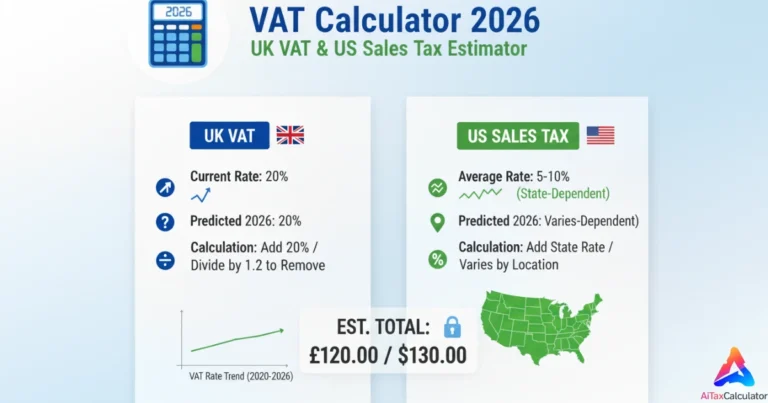

Use this VAT Calculator 2026 to calculate Value Added Tax quickly and accurately. This Tax calculator is designed for business owners, freelancers, online sellers, and service providers who charge VAT in the UK or want a VAT-style tax comparison with U.S. sales tax.

You can calculate VAT inclusive, exclusive, or reverse VAT amounts instantly.

VAT Calculator 2026

VAT / Sales Tax Calculator

2026 USA & UK Tax Calculator

- Reduced Rate: 5% (energy, children’s car seats)

- Zero Rate: 0% (most food, books, children’s clothing)

What Is VAT?

Value Added Tax (VAT) is a consumption tax charged at each stage of the supply chain. Businesses collect VAT on sales and pay VAT on purchases, then remit the difference to the tax authority.

VAT is widely used in:

- United Kingdom

- European countries

- Many international markets

UK VAT Rates for 2026

In the UK, VAT rates generally fall into three categories:

- Standard rate: 20%

- Reduced rate: 5%

- Zero rate: 0%

The standard rate applies to most goods and services. Reduced and zero rates apply to specific items such as energy, food, and children’s products.

How VAT Is Calculated

VAT can be calculated in two common ways:

Adding VAT

Used when you want to calculate the final price charged to customers.

VAT = Net Price × VAT Rate

Removing VAT

Used when you want to extract VAT from a VAT-inclusive amount.

VAT = Gross Price − (Gross Price ÷ (1 + VAT Rate))

This calculator supports both methods.

Who Needs a VAT Calculator?

This calculator is useful for:

- UK VAT-registered businesses

- Freelancers and contractors

- Online sellers and e-commerce stores

- Importers and exporters

- Accountants and finance professionals

VAT vs Sales Tax (UK vs US)

VAT and U.S. sales tax serve similar purposes but work differently.

VAT (UK)

- Charged at each stage of production

- Included in the final price

- Businesses reclaim VAT paid on expenses

Sales Tax (US)

- Charged only at the final sale

- Added at checkout

- Rates vary by state and city

This calculator can also be used as a sales tax estimator by entering the applicable U.S. sales tax rate.

Using This Calculator for U.S. Sales Tax

U.S. businesses can use this calculator by:

- Entering the sale amount

- Entering state or local sales tax rate

- Selecting “Add VAT”

- Viewing tax and total amount

This makes it useful for cross-border sellers and international comparisons.

Why VAT Accuracy Matters

Accurate VAT calculation helps businesses:

- Avoid under- or over-charging customers

- Stay compliant with tax authorities

- File correct VAT returns

- Maintain healthy cash flow

Incorrect VAT handling can result in penalties and audits.

How Often VAT Is Paid

VAT-registered UK businesses usually file:

- Quarterly VAT returns

- Annual returns (optional schemes)

Payments are based on VAT collected minus VAT paid.

Supporting Tools in Your Tax Ecosystem

This VAT Calculator works alongside:

- Freelancer Income Tax Calculator

- Corporate Tax Calculator

- Self-Employment Tax Calculator

- Business Expense Calculator

Together, these tools support global tax planning for UK and U.S. users.

Final Summary

The VAT Calculator 2026 allows businesses and freelancers to calculate VAT or sales tax quickly, whether adding tax to prices or removing it from VAT-inclusive amounts. It supports UK VAT rules while remaining flexible for U.S. sales tax use.

This calculator completes a full international tax ecosystem, helping users stay compliant, accurate, and confident.