Calculating your net salary in the UK means understanding how much of your gross income you actually take home after taxes and deductions. This guide explains every step — including income tax, National Insurance, and other deductions — based on the latest HMRC rates and 2026–27 tax year thresholds.

Understanding Gross vs. Net Salary

Before calculating, it’s important to distinguish between the two key terms:

| Term | Meaning |

|---|---|

| Gross Salary | Your total pay before any deductions (your annual or monthly contract salary). |

| Net Salary (Take-Home Pay) | The amount you receive after all taxes, insurance, and other deductions have been subtracted. |

The Core Components That Affect Net Pay

Your UK salary deductions mainly come from three components:

- Income Tax – Paid according to HMRC tax bands.

- National Insurance Contributions (NICs) – Paid by both employees and employers.

- Pension Contributions or Student Loan Repayments (if applicable).

2026–27 UK Income Tax Bands (England, Wales, and Northern Ireland)

The UK uses a progressive tax system, meaning you pay higher tax on higher portions of income.

| Tax Band | Taxable Income Range (2026–27) | Tax Rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Basic Rate | £12,571 – £50,270 | 20% |

| Higher Rate | £50,271 – £125,140 | 40% |

| Additional Rate | Over £125,140 | 45% |

⚠️ Your Personal Allowance decreases by £1 for every £2 earned over £100,000.

Scotland uses different tax bands set by the Scottish Government.

National Insurance Rates (Class 1 – Employees)

You also pay National Insurance Contributions (NICs), which help fund state benefits like pensions and healthcare.

| Earnings Range (2026–27) | Employee NI Rate |

|---|---|

| Up to £12,570 | 0% |

| £12,571 – £50,270 | 10% |

| Over £50,270 | 2% |

NIC thresholds are aligned with income tax personal allowance for most taxpayers.

Additional Deduction

Other potential deductions can include:

- Pension contributions (auto-enrolment usually between 3%–5% of salary)

- Student loan repayments (Plan 1, 2, or 4 depending on when and where you studied)

- Company benefits (e.g., car allowance, health insurance, share schemes)

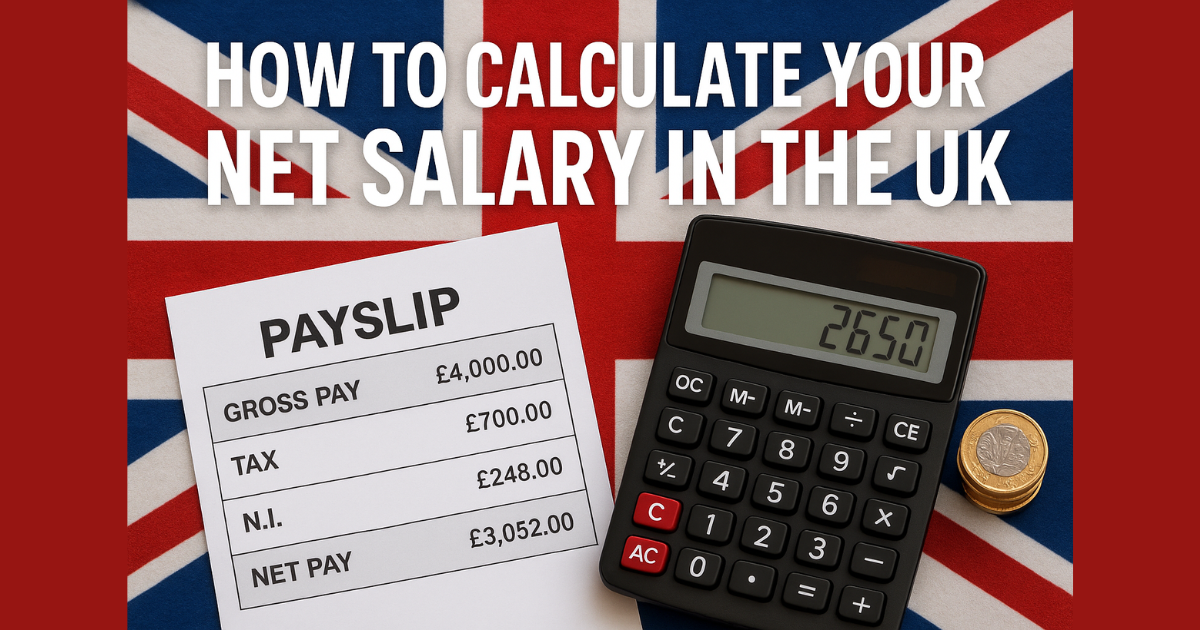

Example: UK Net Salary Calculation (2026)

Let’s calculate take-home pay for a full-time employee earning £40,000 per year.

| Step | Description | Amount |

|---|---|---|

| Gross Annual Salary | — | £40,000 |

| Tax-Free Personal Allowance | First £12,570 not taxed | £12,570 |

| Taxable Income | £40,000 – £12,570 | £27,430 |

| Income Tax (20%) | 20% × £27,430 | £5,486 |

| National Insurance (10%) | 10% × (£40,000 – £12,570) | £2,743 |

| Total Deductions | £5,486 + £2,743 | £8,229 |

| Net Annual Salary | £40,000 – £8,229 | £31,771 |

| Net Monthly Salary | £31,771 ÷ 12 | ≈ £2,647 |

Take-Home Pay: £2,647/month after tax and NI.

How to Calculate Your Net Pay Automatically

You can use AI-powered UK Net Salary Calculators (like those on GOV.UK or aicalculatortax.com) that compute:

- Income tax per band

- National Insurance

- Student loan and pension adjustments

- Weekly, monthly, or annual take-home pay

Just enter:

- Annual or hourly salary

- Location (England, Scotland, Wales, or NI)

- Student loan plan (if any)

- Pension contribution percentage

The calculator instantly shows your net pay breakdown.

Tips to Increase Your Take-Home Salary

- Join a salary sacrifice pension scheme – reduces taxable income.

- Claim eligible expenses – e.g., work-from-home allowance or mileage.

- Check your tax code – ensure HMRC has not applied an incorrect code.

- Use ISAs for savings – tax-free investment growth.

UK Net Salary Formula

Net Salary=Gross Salary−(Income Tax+NIC+Other Deductions)\text{Net Salary} = \text{Gross Salary} – (\text{Income Tax} + \text{NIC} + \text{Other Deductions})Net Salary=Gross Salary−(Income Tax+NIC+Other Deductions)

Key Takeaway

Your net salary depends on your gross pay, tax code, and deductions. For 2026, the personal allowance remains £12,570, and basic tax rate stays at 20%. To save time and avoid errors, always use an updated net salary calculator verified with HMRC 2026 data.

What is the tax-free allowance in the UK for 2026?

The tax-free personal allowance remains £12,570 for most taxpayers.

How much income tax will I pay on £50,000 salary in 2026?

You’ll pay around £7,486 in income tax and about £3,743 in National Insurance, giving a net salary of roughly £38,771 per year.

Do I pay less tax in Scotland?

Scotland uses different rates many people earning middle incomes may pay slightly more tax than in England due to additional bands.