Introduction

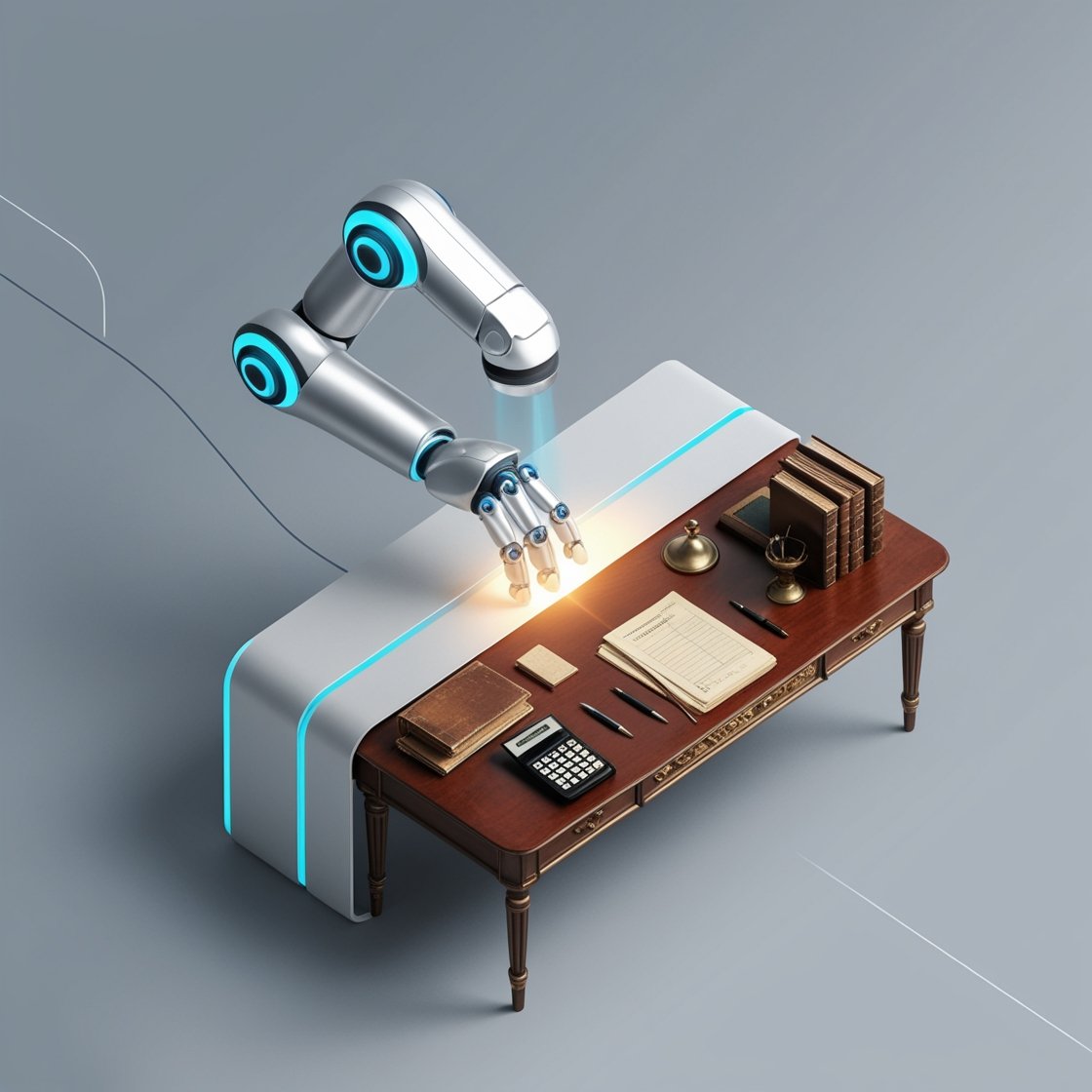

Artificial Intelligence (AI) is reshaping traditional tax services by automating tasks, improving accuracy, and enhancing decision-making for tax professionals. While AI-driven solutions offer efficiency, human expertise remains essential for complex tax scenarios. This article explores how AI is integrated into tax advisory services, the benefits of automation, and the future of hybrid tax solutions.

How AI Enhances Traditional Tax Advisory

AI-driven tax advisory systems leverage machine learning to analyze financial data, detect patterns, and recommend tax-saving strategies. AI tools help tax professionals by identifying deductions, optimizing tax filings, and ensuring compliance with ever-changing tax regulations.

Key Benefits of AI in Tax Advisory:

- Automates routine calculations and compliance checks.

- Provides real-time tax strategy recommendations.

- Enhances decision-making with predictive analytics.

AI for Automating Tax Documentation

Tax documentation is often time-consuming and error-prone. AI-powered Optical Character Recognition (OCR) and Natural Language Processing (NLP) extract data from tax forms, receipts, and invoices, reducing manual input.

How AI Automates Documentation:

- Scans and categorizes tax-related documents.

- Auto-fills tax forms based on historical data.

- Flags potential discrepancies for review.

AI and Human Tax Consultants: A Perfect Pair?

AI does not replace human expertise but enhances it. Tax professionals use AI-driven insights to provide better advisory services, ensuring tax compliance while maximizing deductions and credits.

Why the Human-AI Combination Works:

- AI handles repetitive tasks, freeing up CPAs for strategic planning.

- AI improves accuracy, but human judgment is needed for complex cases.

- Clients receive faster and more precise tax consultations.

Hybrid Tax Services: AI + Human Assistance

The future of tax services is hybrid—blending AI efficiency with human expertise. Many firms are adopting AI-assisted tax platforms to streamline processes while maintaining personal client relationships.

Features of Hybrid Tax Services:

- AI-driven tax planning with human oversight.

- Automated compliance checks with CPA validation.

- AI-powered chatbots for quick queries, with CPA intervention for complex cases.

AI for Reducing Manual Tax Paperwork

Manual tax paperwork is prone to errors and inefficiencies. AI-driven solutions reduce paperwork by digitizing, sorting, and analyzing financial records in real-time.

How AI Minimizes Tax Paperwork:

- Extracts and categorizes data from receipts and statements.

- Auto-generates reports for tax filing.

- Reduces the risk of human errors in tax calculations.

AI Tax Bots for Customer Support

AI-powered chatbots provide 24/7 customer support for tax-related queries. These bots handle FAQs, provide tax deadline reminders, and even guide users through tax filing processes.

Capabilities of AI Tax Bots:

- Answer common tax questions instantly.

- Guide users through filing processes.

- Connect customers to human experts when needed.

How CPAs Use AI for Tax Audits

AI enhances tax audits by detecting anomalies, identifying fraudulent activities, and ensuring compliance with tax regulations. CPAs use AI-driven audit tools to analyze vast datasets efficiently.

AI in Tax Audits:

- Detects inconsistencies in financial records.

- Automates compliance verification.

- Reduces audit turnaround time.

AI for Cross-Checking Tax Returns

AI algorithms cross-check tax returns against financial records to ensure accuracy. Automated verification processes help prevent errors and minimize audit risks.

How AI Cross-Checks Tax Returns:

- Compares reported income with transaction data.

- Identifies missing or duplicate entries.

- Flags potential red flags before submission.

AI and Tax Law Interpretation for Professionals

Tax laws are complex and frequently updated. AI-powered legal research tools help tax professionals stay updated with regulatory changes, ensuring compliance.

AI in Tax Law Interpretation:

- Summarizes legal updates relevant to tax advisors.

- Provides AI-driven legal insights for decision-making.

- Helps professionals navigate tax code complexities.

AI in Virtual Tax Advisory Services

Virtual tax advisory services powered by AI allow clients to receive expert guidance remotely. AI-driven platforms analyze financial data and provide real-time tax optimization strategies.

Benefits of AI in Virtual Tax Services:

- Personalized tax advice without in-person meetings.

- Secure data-driven insights for tax planning.

- Automated tax forecasting for future financial planning.

Contextual Conclusion

The integration of AI with traditional tax services is revolutionizing the industry. By automating manual tasks, enhancing accuracy, and supporting tax professionals, AI is transforming how tax advisory services operate. The future lies in hybrid solutions, where AI and human expertise work together to deliver efficient, accurate, and personalized tax services.